As I plan my next big adventure, I think back on all my vacations. From family road trips to couples’ getaways, each trip is special. But the secret to a stress-free vacation is careful planning and budgeting.

In today’s world, it’s easy to get excited about travel. But without a solid plan, the fun can turn into financial stress. I’m here to share smart ways to budget for a stress-free vacation. This way, you can enjoy your trip without worrying about the cost.

Key Takeaways

- Develop a realistic vacation budget to avoid overspending

- Identify and plan for hidden costs like transportation and accommodations

- Find ways to save on meals and activities while on vacation

- Track expenses during your trip to stay within your budget

- Prioritize your spending to balance splurges and savings

The Importance of Budgeting for Vacations

Vacations are a chance to relax, see new places, and make memories that last a lifetime. But, without a good plan and budget, they can turn into a money worry. Budgeting for your vacation is key to enjoying it fully.

Why Proper Planning Leads to Stress-Free Travel

Having a clear vacation budget means you can afford everything you need. This includes travel, where you stay, food, and fun activities. With a plan, you won’t worry about surprise costs and can enjoy your trip more.

The Hidden Costs of Unplanned Vacations

Spontaneous trips can lead to hidden expenses like last-minute flights and tourist traps. These can hurt your budget and make your trip less fun. Budgeting helps you avoid these surprises and stay within your means.

Travel budgeting does more than just plan your trip. It helps you save for vacations regularly, so you can travel without hurting your finances. It also helps you spend your travel money wisely, making your trips more enjoyable and valuable.

Determining Your Vacation Budget

Planning a vacation is exciting, but knowing your budget is key. It’s the first step to a stress-free trip. By looking at your expenses and setting goals, you can make a budget that fits your needs.

To determine your vacation budget, consider a few things:

- Check your finances: Look at your income, savings, and debts. This shows how much you can spend on your trip.

- Think about your trip: The length and destination affect costs. Research to understand what you’ll spend.

- What do you want from your trip? Prioritize what’s important to you. This helps you decide how to spend your money.

By carefully determining your vacation budget, you can plan within your means. This leads to a worry-free and fun vacation.

| Estimated Vacation Costs | Average Cost |

|---|---|

| Airfare (per person) | $500 |

| Accommodation (per night) | $150 |

| Transportation (per day) | $50 |

| Food and dining (per day) | $75 |

| Activities and entertainment (per day) | $100 |

The table shows typical vacation costs. It’s a starting point for determining your vacation budget. Remember, costs can vary based on your plans and preferences.

Creating a Realistic Travel Budget

Making a detailed travel budget is essential for a worry-free trip. When planning your next vacation, remember to include all costs. This includes transportation and where you’ll stay. A careful budget helps keep your trip affordable and avoids surprises.

Factoring in Transportation Costs

Transportation costs are often high when traveling. You might need to book flights, rent a car, or use public transit. For example, a roundtrip flight from New York to Los Angeles can cost between $300 and $500. Car rentals can be $50 to $100 daily, plus gas.

Estimating Accommodation Expenses

Accommodation costs are also key to your budget. Hotel, vacation rental, or Airbnb prices vary by location and amenities. Expect to pay $100 to $300 nightly for a hotel or $50 to $150 for a rental. Don’t forget to add taxes and cleaning fees to your total.

“By creating a realistic travel budget, you can enjoy your vacation without worrying about overspending or unexpected expenses.”

Budgeting for Food and Dining

Vacations are a time to relax and enjoy good food. But, eating out can quickly increase your expenses. Luckily, there are ways to save on your food budget and avoid overspending.

Saving Money on Meals While Traveling

One smart move is to use free hotel breakfasts. Many hotels, even the budget ones, offer free breakfast. This can help you save money at the start of your day.

Also, pack snacks and non-perishable items for between meals. This way, you won’t have to spend extra on food.

For dining out, look for local eateries and food trucks instead of tourist spots. They usually offer authentic and cheaper food. Don’t forget to check out happy hour specials for discounted drinks and snacks.

| Meal | Average Cost in the U.S. | Estimated Cost with Savings |

|---|---|---|

| Breakfast | $10-$15 per person | $0 (free hotel breakfast) |

| Lunch | $15-$20 per person | $10-$15 per person (local eatery) |

| Dinner | $25-$35 per person | $20-$30 per person (happy hour specials) |

By using these tips, you can save a lot on food and still enjoy great meals. It’s all about being smart with your budget.

Smart Ways to Budget for Activities and Entertainment

Vacations are more than just relaxing. They’re a chance to try new things and enjoy leisure activities. But, these costs can add up fast. It’s key to plan your activity and attraction budget wisely.

One smart way to save is by looking for discounts. Many places offer city passes or attraction bundles that save you money. Also, find free or cheap local events and cultural experiences to enrich your trip without spending a lot.

When setting your activity budget, focus on the top things you want to do. This way, you spend your money on what matters most. Make a list of your priorities and look for ways to save on other entertainment costs.

Another good idea is to find cheaper alternatives to expensive activities. Instead of a pricey tour, use a self-guided app or map to explore. Also, check for free or discounted days at museums, galleries, and historical sites.

By using these smart budgeting tips, you can have a great vacation without overspending. The secret to a stress-free trip is balancing enjoying activities you love with staying within your budget.

Tracking Your Expenses During the Vacation

Budgeting for your vacation is key, but it doesn’t end there. Keeping track of your expenses is just as important. This helps you stay within your budget and avoid surprises. Luckily, many apps and tools can help you track your spending and make smart choices on the go.

Apps and Tools for Expense Tracking

There are many easy-to-use apps and tools for tracking vacation expenses. Here are some top picks:

- Mint – A detailed personal finance app that lets you link your bank accounts and credit cards. It tracks your spending in real-time. It also has features like categorization, budgeting, and alerts to help manage your vacation costs.

- TrabeePocket – A travel expense tracker that makes it easy to log and categorize your expenses. It can also convert expenses into different currencies, perfect for international trips.

- Expensify – A flexible expense management app that lets you snap photos of receipts. They’re then automatically categorized and added to your expense report. It also works with many travel booking sites for easy expense tracking.

Using these apps and tools helps you stay on top of your spending. This way, you can adjust your budget as needed. It makes your trip more enjoyable and helps you avoid overspending.

![]()

“Tracking your expenses during a vacation is essential to maintaining financial control and avoiding budget-busting surprises.” – Travel Advisor, Jane Doe

smart travel budgeting

Creating a smart travel budget is key to a stress-free vacation. By using vacation budgeting strategies, you can enjoy your trip without worrying about money. The main idea of smart travel budgeting is to focus on what’s important and find ways to save.

Start by dividing your costs into must-haves and nice-to-haves. This way, you can plan your spending better. It helps you save for special moments while covering the basics. With a smart financial planning for travel approach, you can control your spending and feel good about it when you get back home.

Prioritizing Your Expenses

- First, list your essential costs like travel, where you’ll stay, and food.

- Then, set aside money for fun activities and entertainment.

- Don’t forget to save for unexpected costs or emergencies.

Identifying Areas to Save

- Look for cheaper places to stay, like vacation rentals or hostels.

- Find affordable ways to get around, like using public transport or carpooling.

- Try local food instead of expensive tourist spots for better value.

| Expense | Budget-Friendly Strategies | Estimated Savings |

|---|---|---|

| Accommodation | Vacation rental vs. hotel | $50-$100 per night |

| Transportation | Public transit vs. rideshare | $20-$40 per day |

| Dining | Local eateries vs. tourist restaurants | $15-$30 per meal |

Using these smart travel budgeting tips, you can make the most of your vacation. You’ll create memories that last without worrying about money.

“Budgeting for a vacation is like planning a road trip – it’s all about mapping out the route, anticipating the costs, and enjoying the journey without any unexpected detours.”

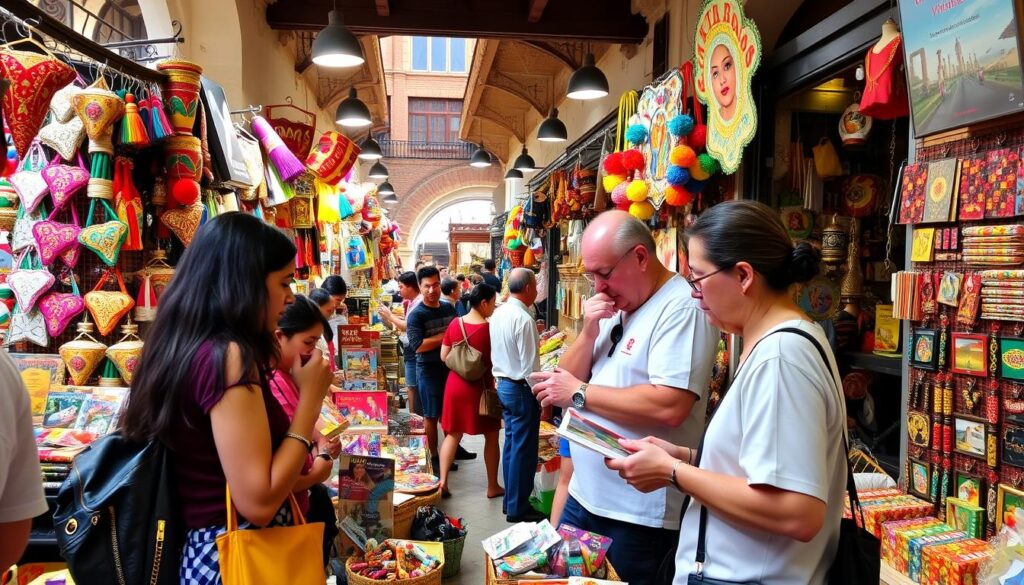

Saving Money on Souvenirs and Shopping

Vacations are a time to indulge and bring home mementos. But overspending on souvenirs and shopping can quickly derail your budget. By following a few savvy strategies, you can save on souvenirs and find unique, local items without breaking the bank.

Avoiding Tourist Traps and Overpriced Merchandise

One of the easiest ways to save money on souvenirs is to steer clear of obvious tourist traps. These shops often mark up prices significantly, taking advantage of visitors’ excitement to bring home a piece of their vacation. Instead, seek out local markets, specialty shops, and artisan studios where you can find authentic, reasonably priced items.

- Research reputable local shops and artisans before your trip to create a list of preferred vendors.

- Avoid stores located near major tourist attractions, as they are more likely to inflate prices.

- Be cautious of street vendors or pop-up shops that may be selling cheap, mass-produced souvenirs.

Another tactic is to time your souvenir shopping wisely. Purchasing items early in your trip, before you’ve spent a significant portion of your budget, can help you make more informed decisions. Additionally, consider waiting until the end of your vacation to do your final souvenir shopping, as you’ll have a better sense of what’s available and what constitutes a fair price.

Remember, the true value of a souvenir lies in the memory and experience it represents, not the price tag. By focusing on quality over quantity, you can find unique, locally sourced items that will serve as lasting reminders of your vacation without draining your budget.

Budgeting for Emergencies and Unexpected Costs

Vacations are meant to be fun, but they can also have surprises. It’s important to budget for emergencies and unexpected costs when planning your travel finances. These can include medical emergencies, transportation problems, or changes in your plans.

When financial planning for travel, set aside a part of your budget for emergencies. Experts say to save 10-15% of your total vacation budget for these situations. This way, you’ll have money ready for any unexpected events during your trip.

When budgeting for emergencies, think about these possible costs:

- Medical expenses, like doctor visits, medications, or hospital stays

- Transportation issues, like flight or car rental cancellations or delays

- Unexpected changes in accommodations or activities

- Loss or damage to personal items, such as luggage or electronics

By planning for theseunexpected vacation costs, you can avoid financial stress. This way, you can enjoy your time off more.

| Potential Emergency Cost | Average Cost |

|---|---|

| Medical Emergency (Inpatient) | $5,000 – $10,000 |

| Flight Cancellation | $200 – $500 |

| Hotel Stay Cancellation | $50 – $200 |

| Lost or Stolen Luggage | $500 – $2,000 |

By anticipating and budgeting for emergencies and unexpected costs, you can have a stress-free vacation. You can then focus on making memories with your loved ones.

The Art of Compromise: Balancing Splurges and Savings

Vacations are a break from daily life but can be expensive if not planned well. The secret to a stress-free trip is balancing spending on fun experiences and saving on everyday costs. Learning when to spend and when to save helps you enjoy your trip without breaking the bank.

When to Splurge

Vacations are for treating yourself and making memories. Think about spending on special activities or experiences unique to your destination. For instance, try a fancy dinner at a famous local restaurant or a unique adventure like a hot air balloon ride.

Also, save a bit for spontaneous treats, like an unexpected night out or a special souvenir. This way, you can enjoy the surprise without feeling guilty.

When to Save

Traveling is also about saving on everyday costs. Look for cheaper places to stay, cook some meals yourself, or use public transport instead of taxis or cars.

Another smart move is to enjoy free or low-cost activities. Visit local parks, museums, or cultural events. By saving on routine expenses, you can spend more on the things that make your trip special.

Mastering vacation budgeting is about finding the perfect mix of spending and saving. With smart planning and room for treats, you can have a fun and budget-friendly trip.

Tips for Sticking to Your Vacation Budget

Planning a vacation is exciting, but keeping to your budget is key. Whether it’s a cheap trip or a fancy one, these tips can help. They’ll keep you within budget and stress-free.

1. Set Clear Spending Limits

First, decide how much you can spend on things like travel, where you’ll stay, food, and fun activities. Set a specific amount for each. Then, try to not go over those limits while you’re away.

2. Use the Cash-Only Approach

Think about not using credit cards and just using cash. This can help you think twice before buying things you don’t really need.

3. Research and Plan Ahead

Do your homework on where you’re going and plan your trip ahead of time. This way, you can find cheaper options and avoid making expensive decisions at the last minute.

4. Embrace Local Experiences

Getting to know the local culture and activities can be cheaper than tourist spots. Look for free or low-cost things to do that really show you what the place is like.

“The key to a stress-free vacation is maintaining financial discipline and sticking to a well-planned budget. With a little preparation and mindful spending, you can enjoy your getaway without breaking the bank.”

By following these tips, you can start your vacation feeling confident. You’ll make sure your money is spent wisely and your trip is memorable. Remember, the best part of a trip is the experiences you have, not how much you spend.

The Benefits of Budgeting for Future Vacations

Budgeting for future vacations is a smart move. It helps make your dream trips a reality without financial stress. By planning ahead and saving regularly, you can enjoy your trips without worry.

Building Vacation Savings into Your Regular Budget

One big plus of budgeting for vacations is adding savings to your monthly budget. This way, you can slowly build a travel fund. It makes it easier to pay for your next trip when the time comes.

To start, decide how much you can save each month. Choose a number that fits your budget, like $50 or $100. By treating vacation savings as a regular expense, you’ll avoid using it for other things.

- Set aside a fixed amount each month for vacation savings

- Treat your vacation fund like any other essential expense

- Watch your savings grow over time, making future trips more achievable

By planning your vacation budget, you’ll feel more secure about your travels. No more last-minute worries or debt for your trips. With a solid budget, you can enjoy stress-free vacations that fit your financial plans.

“Budgeting for future vacations is a game-changer. It allows you to save up for the trips of your dreams and enjoy them without the added stress of unexpected costs.” – Financial Planner, XYZ Investments

Conclusion

As we wrap up our guide on smart vacation budgeting, it’s clear that planning is key. A well-thought-out budget ensures a stress-free trip. By setting a realistic budget and tracking your spending, you can make the most of your money.

We’ve shared tips to help you stretch your vacation budget. This includes planning for travel, accommodations, food, and activities. These strategies help you avoid unexpected costs, so you can enjoy your trip without worrying about money.

Smart budgeting is about finding the right balance. It’s about enjoying your trip while staying within your budget. By following these tips, you’ll have a great vacation that fits your budget and goals. Happy travels!