If you have already thought about better managing or clearing your debt, then you have already taken a step in the right direction. As you look to walk down this path, remember debt always isn’t bad. For instance, a home loan can help you buy your dream abode and build a wealthy asset over time.

But, too much debt of the wrong kind, such as credit card dues or borrowing money from friends for unnecessary expenses, can affect your financial health. It can hamper your ability to meet your financial goals and live a debt-free life.

Thus, debt management and clearance become necessary to reach your financial goals quickly. Here is a look at how debt management can help improve your financial health.

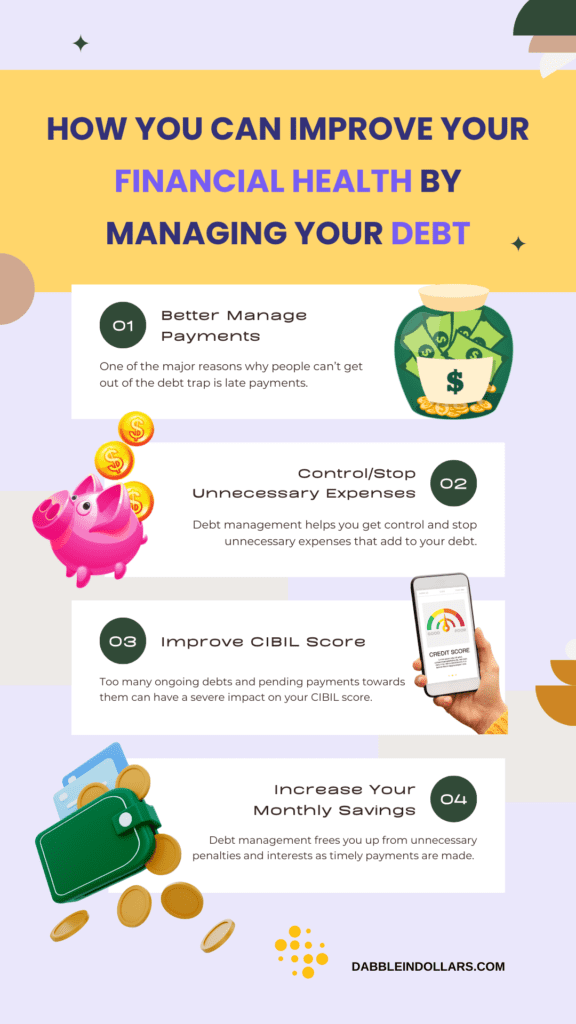

1. Better Manage Payments

Debt management techniques help you take control of your finances. You can better allocate your income to various monthly savings and spending exercises. Thus, you can pay off your debts on time without any worries.

One of the major reasons why people can’t get out of the debt trap is late payments. These attract penalties and interests, which further add to the financial stress.

You can create a monthly bill payment schedule on your smartphone and set an alert to remind you several days before that your payment is due.

2. Control/Stop Unnecessary Expenses

Debt management helps you get control and stop unnecessary expenses that add to your debt. For example, an effective debt management strategy is eliminating the use of credit cards. This helps stop unnecessary spending on unwanted things. You can then use the surplus money to clear your existing debt or invest it in money-growing schemes.

3. Improve CIBIL Score

Too many ongoing debts and pending payments towards them can have a severe impact on your CIBIL score. Your CIBIL score will fall drastically, and you will not be able to secure a loan when you really need it.

Debt management ensures timely payments of your EMIs. This helps improve your CIBIL score over time. You can also opt for a debt consolidation loan to repay your existing debts. As you start paying the EMIs for the consolidation loan, you can further improve your CIBIL score on a regular basis.

4. Increase Your Monthly Savings

Debt management frees you up from unnecessary penalties and interests as timely payments are made. This ensures that you save a little extra money every month that is otherwise spent unnecessarily.

This helps increase your savings gradually on a monthly basis. You can also invest the saved money in stocks, SIPs or mutual funds, to earn additional income on the saved money.

Conclusion

Debt management is an excellent way to take control of your finances and improve your financial health. However, it isn’t a magic bullet. It can only help address debt issues. It won’t stop your bills from coming every month.

Thus, for debt management to work, you will need to have a steady and enough income to cover your expenditures. If not, debt management won’t get you out of the vicious debt trap. You will be stuck forever with various debts.